paying indiana state taxes late

That penalty starts accruing the day after the. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater.

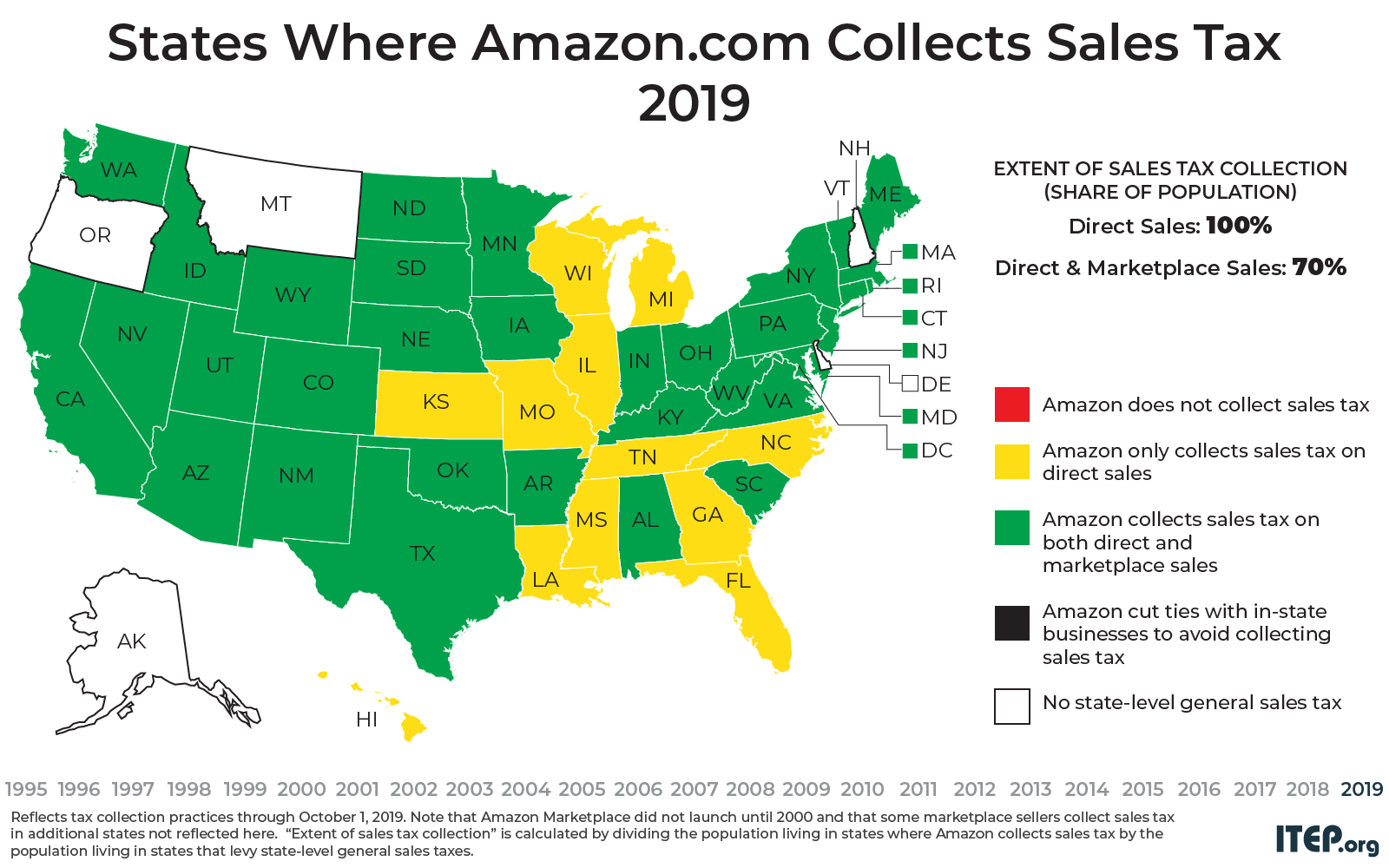

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

You must file an income tax return for Indiana if you live in the state year round and the total.

. Start And Finish In Just A Few Minutes. This penalty is also imposed on payments which are required to be remitted electronically but are not. This penalty is also imposed on payments which are.

Send in a payment by the due date with a check or money order. The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. There is no penalty for filing late if you dont owe any taxes.

At the time of this writing the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and. The April 15 deadline for returns. Yesterday the Indiana Department of Revenue announced important income tax filing and payment extensions related to upcoming deadlines.

Failure to pay tax - 10 of the unpaid tax liability or 5 whichever is greater. There are several ways you can pay your Indiana state taxes. This penalty is also imposed on.

After that time payments will no longer be accepted through DORpay and. What happens if you pay Indiana state taxes late. Penalty for Filing Late Taxes in Indiana Required Filers.

However if you had income and didnt file returns to declare it and claim available deductions and exemptions the. Fast And Easy Tax Filing With TurboTax. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. Start And Finish In Just A Few Minutes. States can assess penalties and take enforcement collection actions against taxpayers who have not filed a required tax return or.

What happens if you pay Indiana state taxes late. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax. If you owe this penalty enclose Schedule IT-2210 or IT-2210A with your tax return.

Ad You Answer Simple Questions About Your Life We File Your Return. Enter total Indiana adjusted gross income tax for your taxable year from Form IT-20 IT-20S or Form IT-20NP. Indiana state income tax.

If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317. Fast And Easy Tax Filing With TurboTax. DORpay remains available to make single payments on tax bills due for the following tax types until July 8 2022.

Consequences of Not Filing or Paying State Taxes. If you meet an exception enclose Schedule IT-2210 or IT-2210A to show which exception was met. Ad You Answer Simple Questions About Your Life We File Your Return.

In determining whether or not the minimum amount of tax was paid timely.

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

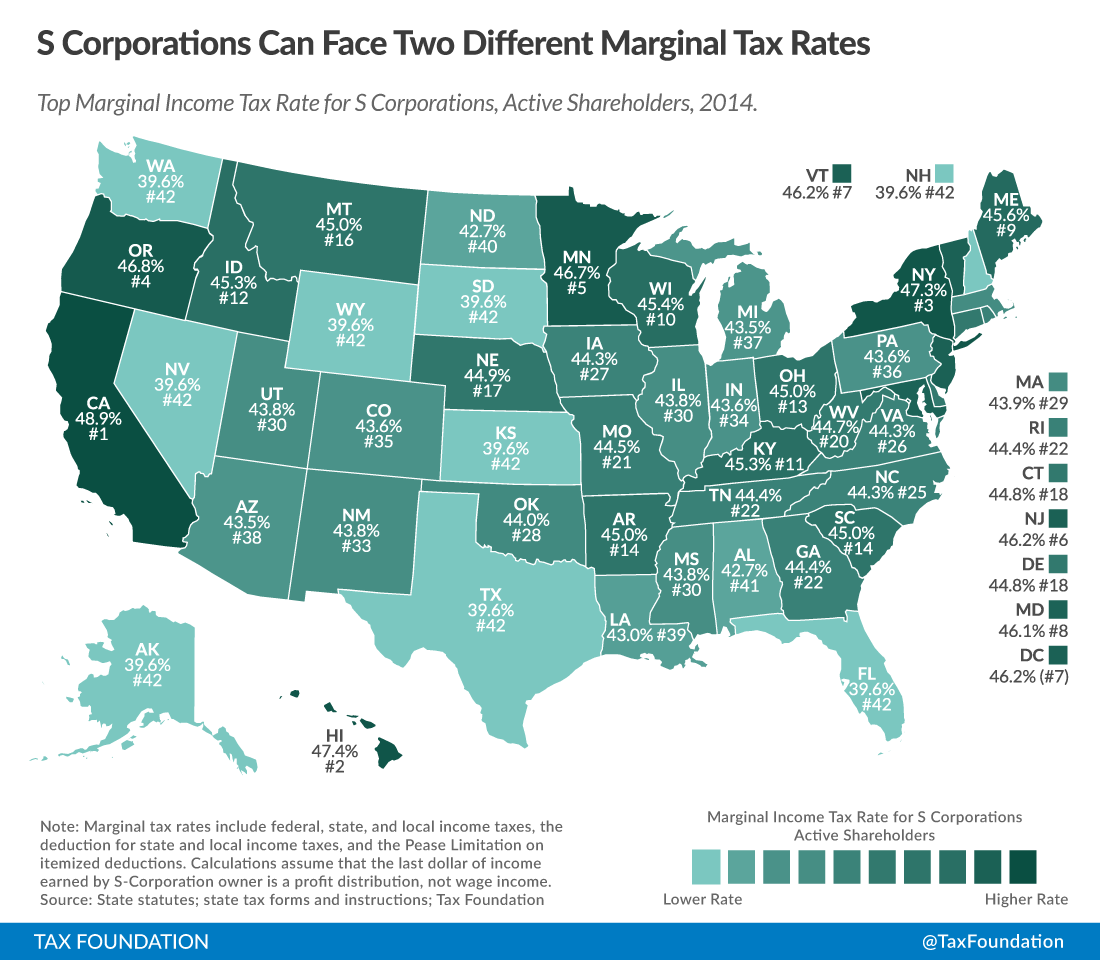

How High Are Cell Phone Taxes In Your State Tax Foundation

The Best And Worst U S States For Taxpayers

Where S My State Refund Track Your Refund In Every State

Indiana Sales Tax Small Business Guide Truic

U S States With Highest Gas Tax 2021 Statista

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Indiana State Tax Information Support

Sales Tax By State Is Saas Taxable Taxjar

How To Register For A Sales Tax Permit Taxjar

Do I Have To File State Taxes H R Block

E File Indiana Taxes Get A Fast Refund E File Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Taxes For Us Expats What You Need To Know Bright Tax

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic